MAN2002 Family Business Management Session #1

Session 1: Oct 6, 2021

The beginning of class started with the professor explaining about the peer learning process and how it affects the learning experience of students. The group assignment and the individual assignment were also briefly touched upon. The theories, concepts and models, discussed in the case study and problems, applied to get a better solution is vital. How entrepreneurs can identify their business opportunity through being creative.

We also found out how a company can be identified as a family business.

Contractual basis: shareholder agreement = initial contract between the shareholder of the company, protecting the minority shareholder. Tag along, drag along. Investor → venture capital firm (collects money from investors and invests in firms) → business. VC has to sell it back to pay investors. V.C have the right from the shareholder agreement to sell your shares. It is important to think of decision-making rights when looking at definitions. Voting rights are important for entrepreneurs to keep control of their company, through preferred share or value of shares.

Sage Case Study was introduced after the break. Decision making and internal conflict were prominent in the family business; therefore, strategy and a medium (someone) is important in order to be able to make decisions. When creating a company with someone, a person has to have 51% of the share in order to be able to have good governance, to avoid blockage of decisions and possibility of bankruptcy. Transition of generations is also an issue + how they can grow internationally without giving away too much share from the company. Structural relationships are important (shareholder agreement) within the family.

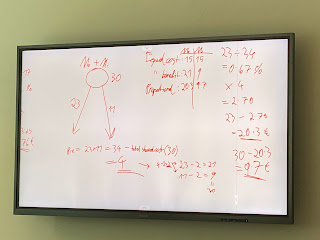

Example in class on how to maintain a leverage in the decision-making process as an entrepreneur:

SA/AG/Ltd.

100,000 CHF money/cash

1 share/1 CHF → 100,000 shares

Rights: voting rights 1 share/1 vote

Comments

Post a Comment