MAN2002 Family Business Management Session #4 and #5

Session 4 and 5

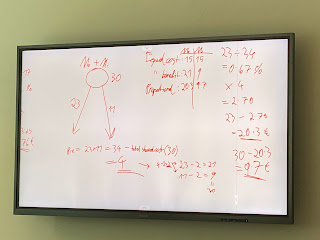

In today’s lesson, we first started with a review of key terms and situations. We were reminded of principal-agent conflict: usually principal is the shareholder who doesn't want much risk, agent is the manager who wants to take more risks, usually they don't own the company (although partially liable, they are not losing their own money) they are interested in their career (personal agendas).

When asked what were some of the ways to raise capital for a business, our classmate Christina said crowdfunding, through this you get preferred stocks, without decision making rights. In Switzerland, there is PZ, which is an equity but it's a hybrid between preferred stock and bonds in the case of liquidity/bankruptcy. It provides better protection than equity and a guaranteed dividend or a certain percentage of the profits.

We also dove into convertible bonds again, it is a bond that can be convertible to shares at the end of the period. If someone wants to invest, the advantages of converting it after a certain period of time is there. They avoid doing it on a yearly basis so every second or third year, they issue new convertible bonds to raise capital. They do this to raise enough money to meet their cash requirements for the period. If difficulty arises, they issue convertible bonds to raise capital for immediate cash requirements, and with the next capital increase, they convert bonds into shares. They can grant discounts on the valuation, or MFN. The advantage to this: when they have convertible bonds, or preferred shares, they generally include voting rights in the shareholder agreement, they also have a say or participation rights where they can raise either opinion or have a vote on important changes in the company (when shares are sold or company is sold) so there is a balance of power.

Purpose of feasibility analysis: analyzing the products and seeing who wants the product, industry and the target market is about competitiveness and the size of the market, organization is whether we have to organizational capabilities to execute and exploit this business opportunity and finance is whether we have the financial resources to implement that.

Then, we discussed our case studies and went on to the next lessons. We did a case study on Etsy where we filled in the Business Model Canvas and then the Lean Canvas. Here we can see the difference between them is that the ladder is more conceptual, not so much operational. I learned that for the business model canvas, the left side is the cost to the business and the right side represent revenues, or generating revenues.

- customer segments: Who are we creating value for?

- Value: what we need to provide to them and how it would satisfy the customers?

- channels: How to deliver these services?

- customer relationship: What type of relationship does the customer segments expect and want to maintain

- revenue streams: Best strategy to capture most value, profit, money. Example: One-time fee, multi-subscription fee.

- key resources: Patents, what you can provide to the customer intellectually, human resources, cost and balance sheets

- key activities should be aligned with the value proposition, if not, then something is wrong because most important activities are not delivering any values to your customers.

- key partners are important but it is not something you do yourself, example: Spotify, BioNTech bring together necessary resources to scale up so quickly.

- cost structure: map key activities to costs to ensure costs are aligned with value propositions.

On the other hand, Lean Canvas changes a few things around such as having options for Problems, Solution, Key Metrics, Unfair Advantage, and sub-categories such as high-level concept and early adopters.

- Customer segment: narrow down the segment, separating users and customers, first to use the raw product (early adopters to provide feedback).

- Problem: customer problems meant to solve, closest competitors that solved the specific problems, consumer and users, existing alternatives

- Revenue streams: list how your product will generate revenue from each customer segment

- Solution: what experiences are customers meant to have?

- Unique Value Prop: uniqueness of your product and its key difference from the existing alternatives; High level concept: short statement about your product

- Channels: specify communication channels

- Key metrics: measure the progress of your business

- Cost structure: list fixed and variable costs; breakeven points: cost for product development, infrastructure & support, marketing expenses and salaries.

- Unfair advantage: special thing about your idea that competitors are not able to copy or obtain in any possible way; low priced rides at the push of a button.

Comments

Post a Comment