BUS2001 European Business Environment Session 1

The course contents of the class were thoroughly explained and discussions were made in class that were related to the European Business environments, including employment rates, GDPs, and employment benefits.

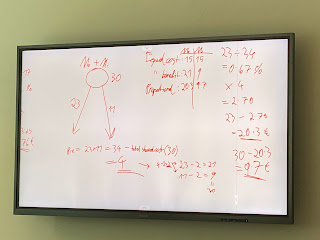

The professor went on and explained about the government debt and deficits and the introduction of the Maastricht criteria for the EUROZONE members to guarantee price stability. Financial consolidation is not an option for the government as they are increasing their debt. Other solutions such as quantitative easing (introduction of new money by central bank) and the current PEPP program (pandemic emergency purchase program) and the debt cancellation were also touched upon. We also learn that inflation increases on nominal government debt. Moreover, starting from 2021, the introduction of the EU debts were issued to fund and support its own governments.

We then separated into 4 groups and worked on answering the questions in the respective solutions. Since my team did inflation, here are my key takeaways: Inflation, or the gradual increase in the price of goods and services over time, has a variety of positive and negative consequences.

Inflation reduces purchasing power, or the amount of something that can be bought with money.

Because inflation reduces the purchasing power of currency, customers are encouraged to spend and store up on products that depreciate more slowly.

It decreases borrowing costs and reduces unemployment.

When household debt levels are high, politicians find it electorally advantageous to print money, causing inflation. Politicians have an even stronger incentive to print money and use it to pay off debt if the government is significantly in debt.

Only companies with strong price setting power can change the price, others would have a loss. Growth needs to be higher than inflation rate.

Comments

Post a Comment