BUS2001 European Business Environment Session 2 & 3

We started the class with the review of the previous class, which was about debt and deficit. Up to a level of 85% of government debt is supportive to growth. We also know alot of government investments and spendings which has led to the development of technological advances, leading companies to take advantage of the progress.

We also learned that politicians tend to hesitate in building infrastructure as they have to maintain it but most importantly, because it takes time to get results as they want to be re-elected. They tend to promise taxpayers to reduce tax or give exceptions.

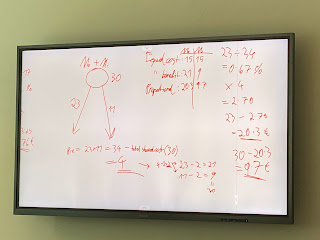

Quantitative easing can be issued through government bonds and when we buy that bond, we are simultaneously lowering the interest rate and in turn, keeping inflation low and stable. On the other hand, governments use quantitative easing to increase the money supply in the economy—this leads to an increase in consumer spending, bank lending and bank reserves. Inflation means there’s a growth in GDP which means that the debt of a nation can grow or at least maintain the same rate. Debt over 85% is going to decrease the attractiveness of a market.

We also touched upon the misconception of having children and it helped the growth of the economy. In the long term, it does but not necessarily in the short term. As Lilian explained, a lot of parents might have to stay home in order to watch over and take care of their children during that time, which in turn, would decrease the workforce.

What is often done to facilitate economic growth and have a competitive advantage is to track talent and capital, especially from migration. Then, we had a discussion about whether refugees were a positive or negative addition for a country. These days, talented foreign workers are very much sought for. Usually, the more skilled a person is, the less likely they are to stay in their home country. We then did a group assignment comparing our chosen country and will discuss the findings next class. Nevertheless, here are the findings from my country of choice.

Luxembourg:

GDP: 73.35 Billion

GDP per capita: 115,873.60 USD

GDP Growth: -1.8%

Population: 0.63

Fertility Rate: 1.3

Population Growth: 2.0%

Education: 104.654 % gross

Average scores of PISA: 470

Luxembourg has the lowest old-age-dependency ratio in the EU – 20.5 (ratio between the number of people aged 65 and over and the working age population 15 - 64).

Comments

Post a Comment